The latest news relevant to you and your business

Coming Soon: Your New PrestigePRO

Are you ready for the PrestigePRO transformation? It’s almost here! The new user experience (UEX) will feature enhanced intuitive design, upgraded tools, and innovative features. We recently hosted a webinar with an in-depth overview exploring the revitalized reporting center, alignment with new technology, improved dashboard elements, unified navigation, and a host of additional enhancements.

Watch the webinar here and read below for a summary of what we covered.

PrestigePRO will soon have an updated, modern design with improved response behavior while you navigate the website. All dashboard widgets have been redesigned, and the paid time off tool has been upgraded.

The report center will receive a significant upgrade.

- Single Reporting Architecture: Ensure the Platform in place can address the needs of the entire PrismHR Product Family

- New Tech Alignment: Platform Architecture that integrates with Data Warehouse and other modern data technologies

- Support Basic to Advanced Users: Technology / Interface to address simple Reporting Access to Power Users leveraging Advanced Functionality (Calculations, Joins, Data Importing)

- Dashboards and Visualizations: Ability to easily create Dashboards / Visuals not only in Report Center but embedded in other products

- Accelerated Schedule: Deliver all these requirements over the next 12 months

You will be able to create reports from scratch and rename column headers. We will also add custom field calculations, data visualizations, and edit joins on existing reports. You’ll also be able to schedule reports in new, more convenient ways and create business rules for a smooth workflow.

- Data Import – Provide the ability to upload CSV data to Snowflake. Allows for cross-reporting of existing and 3rd party data (summer 2024)

- Report SQL – Write SQL Statement for the creation of reports or data sets

- Streamlined Report Delivery – Create and deploy new reports without the need for Engineering or Development resourcing

This is the current roadmap you can expect from the PrestigePRO updates.

Phase 1

Next-Gen

RC

Jan 2024 (Beta)

Deployment of Next-Gen RC

Continue Dev for Data Reconciliation

Replicate RC Home page and Admin Center

Introduction to new reporting interface

Creation of dashboards

Phase 2

Advanced Features

Q1 of 2024 (live)

Creation of dashboards

Complete migration of all PHR Default reports to Snowflake and Next-Gen RC

Set license type by user role

Sharing of reports

Phase 3

WSM Acceleration

Q1 of 2024 (live)

Importing data into the warehouse

Column-level security for all attributes

Integration of Dashboards on worksite manager project

Update Benefit Reports

Dashboarding for SMBs

If you have any questions, please contact Joe Dodgson, our CTO, at jdodgson@prestigepeo.com.

PAYROLL

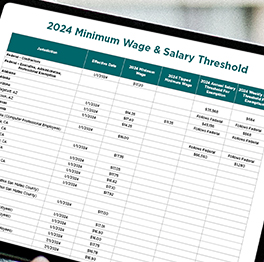

Review Our 2023 Payroll Guide and Our 2024 Minimum Wage Updates

The end of the year is nearly here! Make sure to take a look at our minimum wage and salary threshold guide, which will give you important deadlines and deliverables as you wrap up your books. Please also review our 2023 Payroll Year-End Guide, which will give you a thorough walkthrough of the W-2 and W-4 forms, information about bonuses and payroll adjustments, and items to share with your team members.

Sign Up for W-2 Electronic Access: Fast, Efficient, and Easy!

Let’s simplify your HR work. We have another copy-and-paste tidbit to share with your employees. The text is in italics below, ready to copy and paste into an email to your team. As always, you can reach out to your HR Business Partner with any questions.

Hi team. Please see this W-2 tip provided by PrestigePEO. The end of the year is fast approaching, and now is the time to get ahead of the game by enrolling in our electronic W-2 program. Electronic W-2s are usually available 2-3 weeks ahead of the traditional paper W-2, which are sent via regular mail. We encourage employees to enroll for their electronic W-2 by January 3, 2024; otherwise, it will be sent by mail. Opting for an electronic W-2 is quick, easy, and accessible through the Employee Self-Service portal. Please follow the simple steps below:

- Log in to your PrestigePRO Employee Self-Service account (If you do not have an account, you may create one by clicking the “Register” button and then following the instructions).

- Once logged in, click the “Taxes” tab on the left, then click “W-2.”

- Please review the “Early W-2 Election Terms and Conditions,” then click the consent box and click “Enroll”. Once you are enrolled, you will see a green notification.

- In addition, be on the lookout for the Prestige Pulse newsletter being emailed to you on 12/14. You will receive more information on the W-2 form breakdown, including a step-by-step guide, where to locate the W-2, and an invitation to a webinar to get all your questions answered.

BENEFITS

New FSA and Commuter Benefits Limits for 2024

Each year, the IRS reevaluates the maximum amounts employees are permitted to contribute to flexible spending accounts, daycare accounts, adoption assistance, and commuter benefits. These adjustments account for cost-of-living increases. These benefits allow employees to reduce their taxable income with funds dedicated to healthcare costs, childcare, adoption, and commuter costs.

The IRS has announced the following new contribution limits for 2024:

Flexible Spending Accounts

- Healthcare Flexible Spending Account – $3,200 (increase of $150)

- Flexible Spending Account Carryover Maximum – $640 (if applicable; increase of $30)

- Dependent Daycare Account – $5,000 (no change)

- Adoption Assistance – $16,810 (increase of $860)

Commuter Benefit Accounts

- Parking Benefit – $315 (increase of $15)

- Transit Benefit – $315 (increase of $15)

The deadline to enroll or re-enroll in FSA for 2024 is December 31, 2023. Note: If you are currently enrolled and have unused 2023 funds available, you may roll over up to $610 in funds into 2024.

If you’re interested in making a change to your current elections, please fill out this form and send it to your Benefits Specialist.

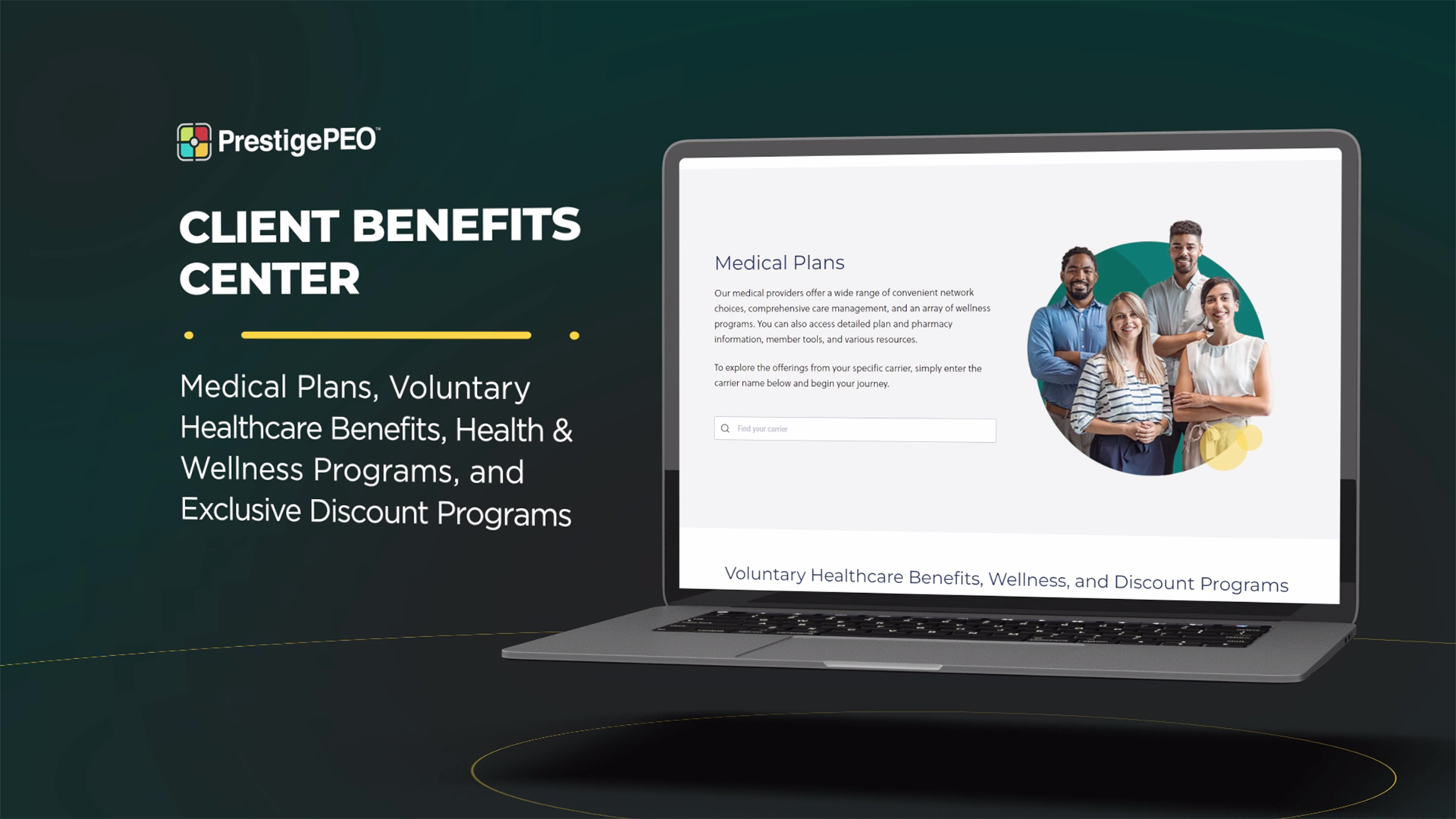

Introducing the Client Benefits Center

Do you know how much your health insurance plan can do for you? There is so much more than just your annual check-up and prescription copays. We’re proud to share our brand-new Client Benefits Center to house all this information in one convenient place. In the “medical plans” search bar, just search for your insurance company, and you’ll be taken to a detailed page with pharmacy information, member tools and resources, forms, and more. For managers, our Client Benefits Center also has compiled a helpful list of workforce solutions, benefits, and tools. You’ll also find a comprehensive list of our voluntary benefits and discount programs. Take a look at the page below, and be sure to bookmark or save the page as a favorite for easy access.

Reminder: The Deadline to Sign Up for Apple Fitness+ Is Approaching!

Apple Fitness+ is a new wellness offering included in eligible UnitedHealthcare plans. See if your health plan includes a 1-year Fitness+ subscription. To check eligibility, visit your myuhc.com® account. What’s more, your subscription can be shared with up to 5 eligible family members! Get ready for a different type of fitness experience with trainers who aim to inspire with a welcoming approach. You have until December 20, 2023, to enroll for this special offer, so don’t wait! Redeem at the link below.

* Please note: You have 12 months of complimentary Apple Fitness + starting from the date you enroll. You must sign up by December 20, 2023, to take advantage of this offer.

PrestigePEO sends an informational newsletter entitled “The Pulse” to all employees each December. The Pulse contains information about W-2s, FSA benefits, our PrestigeGO mobile app, the Client Benefits Center, and more. If you prefer to have your employees removed from The Pulse mailing list this season, you can simply opt-out. Click here to submit a request by Wednesday, December 13, 2023.

The Pulse newsletter will be delivered on December 14, 2023. You will receive a preview of The Pulse newsletter on December 13, 2023, including a final opt-out request.

Click the button below to preview the 2023 edition.

Employee Performance Check-In Before We Start the New Year!

As 2023 comes to a close and you reflect on the past year, consider your employees and how they performed this year. Did some take on more responsibilities? Did others fall back and do the bare minimum? As we look to 2024, take some time to check in with your employees, review their roles, and see what their goals are in the upcoming months. These conversations can naturally navigate their performance and your expectations. Regardless of whether you’d like them to step up and do more, or you think they’re overachieving and deserve recognition, we put together a quick guide on how to navigate performance management.

Looking for an employee performance management solution? Look no further than ClearCompany. Design, automate, and manage any type of employee review for better goal alignment and tangible insights into your workforce. Regular goal setting and automated check-ins plus real-time feedback on workplace surveys can vastly improve your employee engagement and enhance your current work environment.

To read the blog post and learn more about ClearCompany, click the buttons below.

Important Employee Retention Tax Credit (ERTC) Update

In September 2023, the Internal Revenue Service (IRS) placed a moratorium on processing new Employee Retention Tax Credit (ERTC) claims due to rampant ERTC fraud. The IRS has since accumulated a backlog of over 1 million unprocessed ERTC returns. The IRS has not indicated when it will be ending the moratorium.

PrestigePEO has been in ongoing contact with the IRS about our pending ERTC returns. In a positive turn of events in December 2023, the IRS indicated a willingness to try to expedite our pending claims given our CPEO status; however, how quickly they will be processing our returns is still being determined.

PrestigePEO also continues to receive new ERTC requests from clients. Since the ERTC has been available to employers since 2020, PrestigePEO will not accept any new ERTC requests after January 31, 2024. All clients who have yet to request ERTC through PrestigePEO must submit any new ERTC request by January 31, 2024, including returning our required attestations and credit calculations. As a reminder, clients are expected to tell us how much they want to claim in credits for each quarter, given the ERTC statutes and regulations. PrestigePEO will not accept any new requests after the January 31, 2024, deadline. This will allow us time to file any further claims by the applicable statute of limitations deadlines and focus on outstanding ERTC matters. Please note, PrestigePEO will file any new claims after the deadline and at a date that is to be determined.

If you have been considering a new ERTC request, you can obtain the applicable paperwork from your Payroll Specialist or HRBP. We also have ERTC calculation reports for those clients who may need assistance with calculating the credits. You do not need to do so again if you have already submitted your ERTC request to us.

We appreciate our clients’ continued patience as we work with the IRS to process your ERTC requests.

For more information about the IRS’ backlog and communication on the ERTC moratorium, please visit the IRS website here and here.

COMPLIANCE

Important Compliance Alerts

In an effort to keep you informed about compliance updates that may affect your business, we have compiled this list of alerts. Some of these alerts are only applicable to clients with businesses or employees in certain states, and the alert will reflect that. Please read below for more information.

Chicago, Illinois Paid Leave and Paid Sick and Safe Leave Ordinance: Effective December 31, 2023

On November 9, 2023, the Chicago City Council passed a new Chicago Paid Leave and Paid Sick and Safe Leave Ordinance, expanding the current Chicago Paid Sick Leave Ordinance. The new ordinance will become effective on December 31, 2023, and will provide eligible employees with the ability to earn forty (40) hours of paid leave and forty (40) hours of paid sick leave every twelve (12) months.

Who is covered?

The new ordinance significantly expands paid leave requirements for Chicago employers and applies to all employers that employ at least one eligible employee; however, the new requirements will not interfere with the rights of employees currently covered under specified collective bargaining agreements.

Eligible employees are defined as any employee who, during any two-week period, performs at least two hours of work while physically present within the geographic boundaries of Chicago, including compensated travel time.

Accrual or Frontloading

Starting January 1, 2024, or on an eligible employee’s first day of employment, whichever is later, employees are entitled to accrue one hour of paid leave and one hour of paid sick leave for every thirty-five (35) hours worked, for a total of up to forty (40) hours of paid leave and forty (40) hours of paid sick leave per year. Exempt employees are treated as working forty (40) hours per week. The twelve-month accrual period for an eligible employee shall be calculated from the date the employee begins to accrue Paid Leave and Paid Sick Leave. Although the ordinance allows employers to provide a greater accrual rate than the minimum rate set out under the ordinance, both paid leave and paid sick leave must only accrue in hourly increments (not fractionally) unless an employer provides more than forty (40) hours of each type of leave. Employers that offer more than forty (40) hours each of paid leave and paid sick leave may instead credit all leave hours under the ordinance on a monthly basis.

As another option, employers may opt to frontload paid leave and paid sick leave, providing access to each leave on the employee’s first day of employment and/or the first day of a designated twelve- month accrual period. The unlimited or flexible paid time off (PTO) policies that grant immediate access to PTO are also allowed under the ordinance.

Uses of Paid Leave and Paid Sick Leave

Paid Leave: Employees may use paid leave for any reason of the employee’s choosing in minimum increments of four (4) hours (or less, as set by employer policy), and employers may not require the employee to provide a reason for taking paid leave. Employers may, however, implement reasonable polices for the use of paid leave to:

- Require employees to give reasonable notice (which may not exceed seven days).

- Require employees to obtain reasonable preapproval prior to using paid leave for the purpose of maintaining continuity of operations.

- Adopt rules specific to interns and certain city-employed staff, which are classes of employees the ordinance specifically excludes from coverage.

Paid Sick Leave: Employers may require up to seven (7) days’ notice if the need for such leave is reasonably foreseeable, or as soon as practicable when the need for such leave is not foreseeable. However, for paid sick leave purposes, any notice requirement imposed by an employer is waived when the employee is unconscious or otherwise medically incapacitated.

Employees may use paid sick leave in minimum increments of two hours (or less, as set by employer policy) when:

- The employee is ill or injured, or for the purpose of receiving professional care, treatment, diagnosis, or preventive medical care.

- The employee’s family member is ill, injured, or ordered to quarantine, or the family member is in need of medical care, treatment, diagnosis, or preventive medical care.

- The employee or the employee’s family member is the victim of domestic violence or a sex offense.

- The employee’s place of business is closed by order of a public official due to a public health emergency, or the employee must care for his or her child due to the child’s school or place of care being closed by order of a public health official due to a public health emergency.

- The employee obeys an order issued by the mayor, governor of Illinois, the Chicago Department of Public Health, or a treating healthcare provider requiring the employee to remain at home to minimize the transmission or symptoms of a communicable disease or to obey a quarantine order.

Additionally, employers may require certification that paid sick leave falls within one of the above authorized reasons only when an employee’s absence exceeds three consecutive workdays. Records of leave use, which must include certain employee identification information, must be maintained by employers for five years.

Payout Requirements

Paid Leave: The new ordinance includes a series of strict payout requirements. Under the ordinance, at the time of termination, resignation, retirement, or separation from employment, employees must be paid out for all accrued but unused paid leave to which they are entitled, as outlined herein. Employees may also demand payout of accrued but unused paid leave after not receiving a work assignment for sixty (60) days. Due to the carryover requirements set out under the ordinance, which are discussed below, minimum paid leave payout may reach seven (7) days for large employers (defined as employers with over 100 employees). The payout requirements under the ordinance are delayed until January 1, 2025, for medium employers (defined as employers with 51 to 100 employees). Small employers (defined as employers with 50 or fewer employees) are exempt from the payout requirements. Additionally, employers offering unlimited PTO must pay the monetary equivalent of forty (40) hours of paid time off (minus the number of hours of PTO used by an employee within the accrual year at separation).

Many Chicago employers will also be surprised by a novel payout requirement embedded within the ordinance. In addition to the separation payout requirements, Chicago employers will also be required to pay out employees for accrued, unused paid leave when an eligible employee ceases to meet the definition as a result of a transfer outside the geographic boundaries of the city of Chicago. It is not clear how the ordinance will affect hybrid workers who arguably “transfer” between the city of Chicago and their home jurisdiction regularly.

Paid Sick Leave: Employers are not required to pay out unused paid sick leave.

Carryover

At the end of each twelve (12) month accrual period, employees may carry over up to sixteen (16) hours of accrued, unused paid leave and up to eighty (80) hours of accrued, unused paid sick leave. Employers do not need to pay employees for unused paid leave or paid sick leave that is not carried over at year end. However, if an employee who has complied with an employer’s leave policies is denied from “meaningfully having access” to paid leave or paid sick leave, then the employee’s carryover must increase to include any such denied leave.

Employer Notice Requirements

Beginning December 31, 2023, employers will be required to provide postings and reminders that advise employees of their rights to paid time off under the ordinance. Employers must provide conspicuous postings at each work site that explain the rights provided under the ordinance. Employers must also provide employees with an individualized notice of their rights under the ordinance in the employee’s first paycheck and annually with a paycheck issued within thirty (30) days of July 1. Additionally, employers must provide new hires with written notice of the employer’s paid time off policy at the time of hiring and provide existing employees with notice of changes to an employer’s paid time off policy “within five (5) calendar days before any change to the Employer’s paid time off policy requirements.” If an employer’s changes to its paid time off policies modify an employee’s entitlement to final compensation for such leave, the employer must provide a “14-day written notice.”

If the employer’s workforce includes a significant portion of non-English speaking workers, the employer will also be required to post a notice in other languages. Employers that do not maintain a business facility in Chicago are exempt from the posting requirement.

The ordinance’s requirements for notifying employees of accrued but unused paid leave and paid sick leave are another significant change. Employers must provide employees with their balance of accrued but unused paid leave and paid sick leave, in addition to a reminder of the accrual rates “[e]ach time wages are paid.” Employers entitled to use a monthly accrual system will be able to provide this balance update on a monthly basis instead.

Penalties

The ordinance contains harsh penalties, including the potential for businesses to become ineligible to operate in the city of Chicago. Any employer that violates the paid sick leave provisions of the ordinance may be fined between $1,000 and $3,000 for each separate offense. For violations of the notice-posting requirement, employers may be fined $500 for the first violation and up $1,000 for subsequent offenses. In addition, the ordinance grants employees a private right of action and employers may be liable to the employee for a violation of the ordinance for “damages equal to three times the full amount of any leave denied or lost by reason of the violation, and the interest on that amount calculated at the prevailing rate; together with costs and reasonable attorney’s fees.” Private causes of action under the ordinance will be available to recover damages for violations of the ordinance’s paid sick leave provisions, starting on December 31, 2023, and for violations of the ordinance’s paid leave provisions, starting on January 1, 2025.

Next Steps for Employers

- Employers should immediately review their existing paid leave and paid sick leave policies to ensure they are in compliance with the new paid leave and paid sick leave requirements.

- Employers will need to review their employee handbooks and workplace policies, update wage payment notices, and train applicable staff regarding the new requirements. Employers who do not maintain a worksite in Chicago are exempt from the posting requirement.

- Employers currently using “unlimited” time off policy should revisit and reassess the policies.

- Employers do not need to provide any additional Paid Leave or Paid Sick Leave policies if they already have policies that allow employees Paid Leave or Paid Sick Leave in an amount that meets or exceeds the requirements of the Ordinance.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business. If you have any questions regarding Chicago Paid Leave and Paid Sick Leave Ordinance changes or updating your existing leave policies, please reach out to your HR Business Partner.

Minnesota Earned Sick and Safe Time

On January 1, 2024, Minnesota’s Earned Sick and Safe Time (ESST) law will go into effect. While the law itself is similar to existing city ordinances in Minneapolis, St. Paul, Bloomington, and Duluth, employers will be required to follow the more restrictive law when comparing ESST to the various existing city ordinances across Minnesota.

Which Employers does the ESST law apply to, and what types of Employees qualify?

The ESST law applies to companies with one or more employees that have employees who work in Minnesota for, at a minimum, eighty (80) hours a year. While independent contractors do not qualify, full-time, part-time, and temporary workers qualify under the ESST law, so long as they work 80 hours a year for an employer in Minnesota. Employees do not need to live in Minnesota to qualify under ESST law. In addition to not covering independent contractors, the ESST law does not apply to federal employees, cabin crew members of air carriers, flight deck members of air carriers, and certain union employees if there is a valid waiver of the ESST law requirements.

How much Sick and Safe time can employees earn?

For every 30 hours worked, an employee earns 1 hour of Sick and Safe time. If under an accrual method, the law allows for employees to accrue up to 48 hours of Sick and Safe time per year. Employers may allow employees to earn over 48 hours annually if the employer chooses to allow for a higher accrual threshold. Employers using an accrual method must allow employees to carry over up to 80 hours of unused sick and safe time into the following year.

What can an employee use ESST for?

- An employee’s own health care – including mental or physical illness, treatment of that illness, or preventative care.

- An employee’s family member’s health care – including mental or physical illness, treatment of that illness, or preventative care.

- An employee’s absence due to domestic abuse, stalking, or sexual assault of the employee.

- An employee’s absence due to domestic abuse, stalking, or sexual assault of the employee’s family member.

- An employee’s absence due to the closure of an employee’s workplace due to weather.

- An employee’s absence due to the closure of an employee’s workplace due to a public emergency.

- An employee’s absence due to the closure of a family member’s school or care facility due to weather.

- An employee’s absence due to the closure of a family member’s school or care facility due to a public emergency.

- An employee’s absence due to a health care professional or health authority deeming an employee or an employee’s family member has a risk of infecting others with a communicable disease.

Who counts as a family member under ESST?

- An employee’s or their spouse/domestic partner’s spouse or registered domestic partner.

- An employee’s or their spouse/domestic partner’s biological child, adoptive or foster child, adult child, legal ward, child who an employee stands or stood in loco parentis, or child who the employee is a legal guardian of.

- An employee’s or their spouse/domestic partner’s sibling, foster sibling, or stepsibling.

- An employee’s or their spouse/domestic partner’s biological parent, foster or adoptive parent, stepparent, or person who stood in loco parentis of the employee.

- An employee’s or their spouse/domestic partner’s biological grandchild, adoptive or foster grandchild, or step-grandchild.

- An employee’s or their spouse/domestic partner’s sibling’s child.

- An employee’s or their spouse/domestic partner’s child-in-law or sibling-in-law.

- Any other blood relative of an employee or individual whose close relationship with the employee is equivalent to a familial relationship.

- One individual designated on an annual basis by the employee – should the employee choose to designate an individual.

How much are employees paid when out on ESST?

Employers must pay their employees out on Sick and Safe time the same hourly rate as the employee would earn if they were working.

Are employees required to provide prior notice when taking leave under ESST?

If the need for leave is foreseeable, Employers may require at least 7 days’ notice; if the need for leave is not foreseeable, Employers may require employees to provide notice as soon as is reasonably practicable. If employers want to enforce a notice requirement, it must be included in a policy provided to employees.

What are employers required to do?

- Employers must provide notice to their employees of the Earned Safe and Sick Time law by January 1, 2024, or at the start of an employee’s employment (whichever is later). Minnesota has prepared a sample notice document to assist employers; it can be found here.

- If an employer has an employee handbook, they must include a safe and sick time notice to their employees within the handbook.

- Employers must include an employee’s total amount of earned sick and safe time hours used and available for use on employee earnings statements at the end of each pay period.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business. If you have any questions regarding Minnesota’s Earned Sick and Safe Time Law or updating your existing leave policies, please reach out to your HR Business Partner.

Additionally, Minnesota’s Department of Labor and Industry created a detailed FAQ section on its website to assist employers in navigating this new law; it can be found here.

New York’s New Legislation Restricts Employers from Accessing Employee’s Personal Social Media Accounts

New York Governor Hochul recently signed Assembly Bill 00836 and Senate Bill 02518A into law, to take effect March 12, 2024, which will prohibit employers from requesting or gaining access to the personal social media accounts of employees or prospective employees, thus providing New York workers new privacy protections.

This law specifically prohibits employers from requesting, requiring, or coercing any employee or prospective employee to:

- Disclose any username and password or other authentication information for accessing social media or other personal electronic communication accounts through an electronic communication device;

- Access the employee’s or prospective employee’s personal social media account in the presence of the employer or potential employer; or

- Reproduce in any manner photographs, videos, posts, or other information contained within the personal social media accounts obtained by the means prohibited above.

Under this new law, an employer may not discharge, discipline, or otherwise penalize an employee, or threaten to do so, for refusal to disclose the otherwise prohibited information outlined above, nor can the employer fail or refuse to hire any prospective applicant for refusal to disclose this prohibited information.

There are several exceptions to this new law, however, including certain situations where the employee’s social media account is being utilized for business purposes, and the employee is provided prior notice of the employer’s right of access, and limited exceptions when the device is paid in whole or in part by the employer, with the employee’s prior notice and consent.

What are the next steps?

- Before the effective date of March 12, 2024, employers are advised to review related employment social media policies and make updates when necessary.

- Review hiring practices and provide guidance related to the new privacy protections to the individual(s) involved in the hiring and onboarding process.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business. If you have questions or need assistance updating your existing policies, please reach out to your HR Business Partner.

New York’s Proposed Ban on Non-Compete Agreements

A proposed ban on Non-Compete Agreements was passed last summer by the New York State Assembly (A1278B) and is currently awaiting signature from New York’s Governor Hochul. The new provision would amend the state’s current labor law to prohibit non-compete agreements for all workers in the state, regardless of salary, with very few express exceptions. If signed, the bill would become effective thirty (30) days later and would make any non-compete agreement signed or modified after the bill’s effective date unlawful.

PrestigePEO is here to help.

We will continue to monitor this legislation and will provide updates as necessary. Please reach out to your HRBP with any questions or concerns.

Upcoming Changes to Article 6, New York Labor Law

Governor Hochul recently signed legislation that will impact the current provisions of Article 6 of the New York Labor Law, effective March 13, 2024.

Effective March 13, 2024, modifications to the current salary threshold governing employees who may make a “wage theft” claim under Article 6 will increase to ANY employee making less than $1,300 a week. In other terms, anyone making less than $67,000 per year will now be covered by Article 6 and can sue their employer for wage theft. Before this legislation, only non-exempt employees who made $900 a week or less could bring wage theft claims.

Employers will also be required to obtain written employee consent before paying certain workers making below $1,300 a week through direct deposit.

Employer liability under the new provisions:

Expanding these protections under Article 6 will also increase potential liability for employers. With an increased number of qualified employees, there is an increased potential for an employee to file a complaint with the New York Department of Labor, which can expose the entire company to a DOL audit.

If a qualified employee were to bring a civil action in a state court under Article 6, and the employer is found to be liable, the potential penalty per wage theft offense, depending on the severity of the violation, is between $500 to $20,000 per offense, plus attorney’s fees. Employers may also be exposed to criminal liability for violations, including nonpayment or underpayment of wages.

What should employers do now?

Before the March 13, 2024, effective date, employers should begin obtaining written consent for direct deposit for the employees impacted by the new consent requirements and implement changes to include the consent forms for the future onboarding processes of impacted employees.

PrestigePEO is here to help.

PrestigePEO has direct deposit consent forms available as part of our onboarding process for newly hired employees. If you have any questions about this new law or employee compensation, please contact your HRBP.

Federal and State Posting Notice Update

The following mandatory posting updates have recently been announced. If you have offices in the states mentioned below, you will be receiving updated posters shortly. Please post in a common area and remove any old posters. If your business address changes, promptly contact your HR Business Partner to ensure your business receives the latest posters.

Minimum Wage Increases

- Multiple States – Updated posters will be sent for any state or city minimum wage increase for 2024. Please review the PrestigePEO year-end guide and 2024 minimum wage updates.

Ohio Legalization of Recreational Marijuana

Ohio has Legalized Recreational Marijuana – What Does That Mean for Employers?

Ohio has become the 24th state to legalize the adult use of recreational marijuana. Issue 2 was passed on November 7th allowing residents to purchase and/or possess up to 2.5 ounces of cannabis as well as growing it at home. This law took effect on December 7, 2023.

Ohio originally authorized the use of medical marijuana in 2016. At that time, a medical marijuana card was required to possess cannabis, and provisions were put in place to protect employers and allow them to take employment actions if the cannabis use impacted the workplace. The good news is that employers may already have policies in response to the prior law.

How is the Employer Protected?

The recently passed law expands the 2016 law. Any adult 21 or older may possess and use marijuana. Similar to the original medical marijuana bill, employer protections remain in place, allowing the employer the right to discipline and discharge an employee if cannabis use impacts the workplace. In addition,

- An employer does not have to allow or accommodate the use, possession or distribution of cannabis use in the workplace.

- An employer does not have to tolerate cannabis impairment even if caused by lawful use off duty.

- The employer is permitted to refuse to hire, discipline, discharge or any other adverse employment action due to the use, possession or distribution of cannabis in the workplace.

- A drug testing policy is permitted to be established and enforced as well as the creation of a drug-free workplace policy.

- If an employee is discharged due to violation of an employer’s cannabis policy, it will be considered discharged by cause.

What Actions Should Employers Take?

- Review and update drug testing protocols. Be aware of any federal and/or state regulations.

- If there are no mandates, employers need to review and determine their options.

- Policies should be updated if required.

- Offer training to make sure managers have a clear understanding of all policies regarding cannabis use in the workplace as well and testing protocols and disciplinary policies.

- Communicate to employees the position and expectations that the company has.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business. If you have any questions regarding the use of recreational marijuana in the Ohio workplace, please reach out to your HR Business Partner. We will continue to monitor the regulation and inform you of any changes to the regulation.

Illinois- Paid Leave for All Workers Act, beginning January 1, 2024

In March 2023, Governor JB Pritzker signed SB208 into law, making Illinois the third state in the nation, and the first in the Midwest, to mandate paid time off to be used for any reason. The Paid Leave for All Workers Act will begin on January 1, 2024, and it will provide employees with up to forty (40) hours of paid leave during a 12-month period. This new law applies to every employee working for an employer in Illinois, including domestic workers, but does exclude independent contractors.

Leave Requirements

Beginning on January 1, 2024, or when employment begins (whichever is later), covered employees must accrue at least one hour of paid leave for every 40 hours worked, for up to 40 hours of paid leave for every 12-month period. For accrual calculation, overtime exempt employees are generally deemed to work 40 hours each work week, unless their regular work week is under 40 hours.

Employees are eligible to begin taking leave after 90 days of employment with the employer, or 90 days after January 1, 2024, whichever is later. Eligible employees may determine when they use leave and how much they choose to use, but employers may set a minimum leave increment of up to two (2) hours per day (i.e., an employer may require that an employee use at least two hours of paid leave on any given day).

Carryover and Frontloading

Under the Act, employers may choose between an accrual system or a front-loading system. Under the accrual system, paid leave time gradually builds to a minimum of 40 hours over the course of a 12-month period. If an employer opts for the accrual system, it must allow employees to carry over all unused paid leave from one 12-month period to the next.

On the other hand, the front-loading system provides employees with 40 hours of paid leave on the first day of the 12-month period and does not require carryover from year to year. Employers that choose this system may enforce “use it or lose it” policies that require unused paid leave to be forfeited at the end of the 12-month period.

Pay Requirements

The employees will be paid their normal hourly rate of pay when taking the paid leave, under the Paid Leave for All Act. For employees who are regularly paid gratuities or commissions as part of their pay, their pay rate on the paid leave will be at least minimum wage in their jurisdiction of employment. Employers are not required to pay out unused paid leave upon an employee’s separation, unless the employer has “credited” the paid leave to an employee’s paid time off or vacation banks, in which case the usual Illinois rules for paying out unused leave upon separation apply.

Notice and Recordkeeping Requirements

Employers must post a notice, which will be provided by Illinois Department of Labor (IDOL), in a conspicuous place on the employer’s premises and include a copy of the notice in a written document, or written employee manual or policy. If the employer’s workforce includes a significant portion of non-English speakers, the agency will also provide a notice in that language.

Employers must maintain accurate records for each employee showing the employee’s:

- hours worked;

- paid leave accrued and used; and

- remaining paid leave balance

Penalties

For violating the notice/posting requirements, employers will be subject to a $500 civil penalty for the first audit violation and $1,000 civil penalty for each subsequent audit violation. Affected employees will also be entitled to equitable relief including attorney’s fees, reasonable expert witness fees, and other legal costs. Additionally, violators will be subject to a $2,500 civil penalty for each separate offense.

Next Steps for Employers

- Employers must post a notice to be provided by the Illinois Department of Labor (IDOL) in a conspicuous place on the employer’s premises and include a copy of the notice in a written document, or written employee manual or policy in English or other languages.

- Employers must maintain accurate records for each employee, showing the employee’s hours worked, paid leave accrued and used, and remaining paid leave balance.

- Employers must retain employee records for at least three (3) years and must be available for inspection by the IDOL. While an employee’s paid leave accruals need not be reported on a paystub, employers must provide this information to an employee upon request.

If an employer has an existing policy that meets or provides the minimum amount of leave required by the Act (40 hours) in a 12-month period and the employees can in fact take that amount of leave for any reason of their choosing, Employers do not need to modify the terms of their existing policy.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business. If you have any questions regarding Illinois Paid Leave for All or need changes or updates to your existing leave policies, please reach out to your HR Business Partner.

Your W-2 Is Right at Your Fingertips!

Did you know you can find your W-2 on our mobile app? It’s true! W-2s will be available January 15, and you’ll be able to download it on the PrestigeGO mobile app conveniently. All it takes is just a few clicks, and you can either wirelessly print it or save it and use it later to file your taxes. If you don’t have the mobile app yet, click the button below to learn how you can manage critical HR tasks while on the go.

Have questions about your W-2? We have a thorough breakdown video, a step-by-step guide, and instructions on how to print your documents. Find it in our Resource Center. And don’t miss out on our W-2 webinar, which will be hosted on Wednesday, January 24th, at 10:00 a.m. Register here!

Take Your Business to the Next Level in 2024

Are you ready to grow your business in the new year? Support your growth plans with these services.

If you’re looking to grow your team, background checks are an essential element of hiring new team members. ScoutLogic is experienced in working with small to mid-sized businesses, and they pride themselves on making the background check process as simple as possible. Contact your HR Benefits Partner to learn more about signing up for this service.

–

Running a business in today’s world can be full of unanticipated expenses that impact your bottom line. This can make it challenging to grow, as you may be unable to access the capital you need to complete necessary projects. Payroll Funding Company has funded thousands of companies nationwide, specializing in helping business owners who need a lending partner they can trust to understand their needs and provide fast, flexible funding. Learn more below.

Feedback

If you have an idea for a future newsletter, we’d love to hear from you! Additionally, if you’d like more information on our services or programs, we can certainly accommodate that as well. Email marketingteam@prestigepeo.com today!