The latest news relevant to you and your business

FTC Non-Compete Update

As we previously advised, the Federal Trade Commission (FTC) ruled in April that virtually all non-compete agreements for nearly all workers of for-profit employers would be banned effective September 4, 2024. We also provided a webinar on this topic and the DOL Overtime Rule change, which can be found here.

The FTC ruling was almost immediately challenged in court by Ryan LLC, the US Chamber of Commerce, and a few other entities. On Wednesday, July 3, 2024, the US District Court for the Northern District of Texas granted a preliminary injunction against the FTC for enforcing its non-compete rule. However, the injunction was only granted on behalf of the Plaintiffs in that case. Therefore, nationwide, the rule is still slated to go into effect on September 4, 2024. There is an additional case pending before another federal court which may result in a nationwide injunction. However, no ruling has been made in that case yet.

Employers should still be evaluating their non-competes and other agreements that may contain non-compete language to determine their responsibilities should the ban go into effect.

PrestigePEO is committed to supporting your business and will continue to monitor and update any changes as they become available.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business. Please contact your HRBP or HRC for further guidance if you have any questions.

Get Ready for This Year’s Open Enrollment Season and Exciting New Benefits!

Open Enrollment season is approaching, and PrestigePEO is committed to making this year’s process smoother and easier than ever for our clients and their employees. We will provide all the necessary resources and tools to ensure a seamless experience.

Our Renewal Portal is designed to be more robust and user-friendly. It allows you to compare insurance plans and contributions and set up mock models for easy comparison.

Additionally, we’re excited to introduce new benefit products and options that are better than ever. Look out for email notifications in the coming weeks to access your portal, join informative webinars, and begin enrollment. If you have any questions, please reach out to your Benefits Specialist.

Motivity Care

Complicated challenges arise when caring for a loved one, including balancing a career and managing the financial obligations involved. With Motivity Care, employees get a network of 180 trusted resources on aging and care, a platform where they can access all applicable information and documents, and live support from the Motivity Care team. Click the button below to learn more about this exciting benefit offering.

Join The Upcoming Motivity Care Webinar

Don’t miss the Motivity Care’s upcoming educational webinar to learn more about how to overcome care challenges.

Embracing the Journey: Overcome Caregiving Challenges through Coaching

With Life Coach Wendy Taddeucci

July 18, 2024 @ 12 p.m. EST

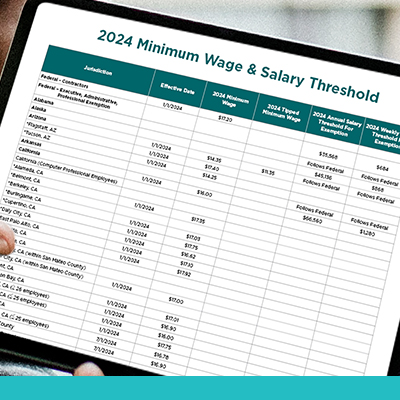

Additional 2024 Mid-Year Minimum Wage Updates

This is your friendly reminder to review recent updated minimum wage requirements as listed by state below.

For quick reference, the increases effective 7/1/2024 are as follows:

- Alameda, CA increased to $17.00

- Berkeley, CA increased to $18.67

- Emeryville, CA increased to $19.36

- Fremont, CA increased to $17.30

- Malibu, CA increased to $17.27

- Milpitas, CA increased to $17.70

- Los Angeles, CA increased to $17.28

- Los Angeles County increased to $17.27

- Pasadena, CA increased to $17.50

- San Francisco, CA increased to $18.67

- Santa Monica, CA increased to $17.27

- Chicago, IL (4 or more employees) increased to $16.20

- Chicago, IL (Tipped employees) increased to $11.02

- Montgomery County, MD (≥ 51 employees) increased to $17.15

- Montgomery County, MD (11 – 15 employees) increased to $15.50

- St Paul, MN (101 – 10,000 employees) increased to $15.57

- St Paul, MN (6 – 100 employees) increased to $14.00

- St Paul, MN (≤ 5 employees) increased to $12.25

- Nevada increased to $12.00

- Oregon increased to $14.70

- Oregon (Urban) increased to $15.95

- Oregon (Non-Urban) increased to $13.70

- District of Columbia increased to $17.50

- Puerto Rico increased to $10.50

Our Payroll Specialists are aware and will connect with you to review any employee who may fall under the new minimum hourly wage.

Don’t Forget: Our Upcoming 401(k) Webinar

PrestigePEO is excited to hold a webinar for 401(k) participants as part of our partnership with Slavic401k for retirement benefits and plans. You don’t want to miss this important webinar if you’re enrolled in a 401(k).

Maximize Your New 401(k) Plan: Slavic401k Service and Resource Overview

July 17, 2024 @ 2:00 p.m. EST

Featuring Arianna Hall, Bruce Robinson, and Melissa Roman

Save your seat if you’re a current BlueStar client! If you’re not on a current PrestigePEO 401(k) plan, reach out to your HRBP to learn more.

Important Compliance Alerts

Delaware Paid Family and Medical Leave Insurance Program signed into law May 10, 2022

On May 10, 2022, Delaware Governor John Carey signed the Delaware Paid Family and Medical Leave Insurance Program into law. The goal of this legislation is to provide up to 12 weeks of protected paid leave to Delaware workers to manage a serious health condition or injury, care for a family member with a serious health condition, care for a new child, or provide assistance to a family member who has been called to active duty in the Armed Forces. This new legislation is set to begin on January 1, 2026, with payroll deductions for funding beginning on January 1, 2025, for those employers in the State’s plan.

In order to be eligible, employees must have been employed by qualified employers for at least one year and have worked at least 1,250 hours with that employer. If approved for leave, the employee will receive up to 80% of their wages, up to $900 per week. However, not all employers are subject to the regulations. Employers with:

- 9 or fewer employees are exempt from the regulations;

- 10-24 employees are subject to only parental leave under the regulations;

- 25 or more employees are subject to full coverage under the regulations;

- Any business that shuts down for a month or longer (typically seasonal) are exempt;

- Federal Government Employees are also exempt from coverage under the regulations.

How much leave time an employee may be permitted to take will be determined by the reason for the leave. Only employees who take leave for the purposes of caring for a new child will be eligible for 12 weeks of leave in a 12-month period. The remaining purposes for leave including medical, family care, or leave for purposes of providing assistance to a family member who has been called to active duty in the Armed Forces are eligible to take a maximum total of 6 weeks of leave in any 24-month period.

If the qualifying reason for leave would also qualify the employee for leave under the federal Family Medical Leave Act (FMLA), the two leaves would run concurrently. Employers may require that employees exhaust unused, accrued paid time off prior to using the leave.

The program will be funded from employee and employer contributions. Under specific circumstances including purchasing a private plan that provides the same or better benefits as the state plan, employers may opt out of the Delaware Paid Leave Plan, but only with the Division of Paid Leave’s approval on a yearly basis. Written notice of the rights and protections afforded by this law must be provided by qualifying employers to employees when hiring a covered employee and when the employee either requests leave, or the employer becomes aware that an employee’s leave may qualify under the regulations. More information on employers’ responsibilities will be forthcoming.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business. Please contact your HRBP for further guidance if you have any questions.

Illinois employers receive clarity on Paid Leave Law: Key updates and implications

Late last year, the State of Illinois passed the Paid Leave for All Workers Act, or PLAW, which went into effect on January 1, 2024. This legislation has implications on how employers manage their paid time off and leave policies, but only recently did the Illinois Department of Labor (IDOL) issued clarity of the PLAW, aiming to provide crucial interpretations and guidelines for employers navigating this new legislative landscape. These new regulations, which become effective immediately, offer both continuity and major changes from the initial proposal, prompting Illinois employers to revise and align their paid time off and leave policies accordingly. Below, we have provided a detailed look at five critical areas highlighted by the Illinois Department of Labor.

- Qualifying Pre-Existing Paid Leave Policies

One of the key clarifications involves qualifying pre-existing paid leave policies. Employers who already offer at least 40 hours of paid leave annually that can be used for any reason are exempt from additional requirements of the Paid Leave for All Workers Act. Below are the specific conditions that apply.

-

- The policy must have been in effect as of January 1, 2024.

- Modifications to these policies are permissible after January 1st, if they maintain the minimum required leave.

- Different policies may apply to different employee groups within the same organization, such as full-time versus part-time employees.

- Carryover

Under the Paid Leave for All Workers Act, if an employee choices the accrual method, or allows employees to accrue paid leave at a rate of one hour for every 40 hours worked, as required, employers are now permitted to limit carryover to 40 hours of unused paid leave from one 12-month period to the next, as a carryover cap, but only if done by utilizing a valid written policy. Alternatively, employers and employees can agree to a payout of unused leave at the end of the period instead of carryover.

- Frontloading

Employers are allowed to frontload paid leave for new hires or part-time employees, prorated based on anticipated work schedules. Importantly, if an employee leaves before the end of the 12-month period after using frontloaded leave, employers cannot seek reimbursement for the used leave.

- Denial of Paid Leave

The final regulations grant employers broader discretion in approving or denying paid leave requests compared to the initial proposal. Employers must disclose their policies for considering leave requests, including any grounds for denial, in writing to employees. The policy must be written and applied to avoid effectively denying employees their entitled leave over a 12-month period.

- Rate of Pay

Employees must be paid their hourly rate of pay when using paid leave, according to the final regulations. This clarification removes the previously proposed “regular rate of pay” calculation, simplifying compliance for employers.

Implications for Employers

The final regulations bring much-needed clarity and structure to the implementation of the Paid Leave for All Workers Act in Illinois. Employers are advised to review and update their PTO policies in line with these guidelines to ensure compliance and mitigate potential risks. Clear communication of policies to employees, especially regarding denial criteria and leave usage conditions, is crucial to maintaining transparency and fairness in the workplace.

Conclusion

The final regulations by the Illinois Department of Labor represents a significant milestone in the ongoing implementation of the Paid Leave for All Workers Act. By addressing critical areas such as pre-existing policies, carryover limits, frontloading practices, leave denial criteria, and pay rates, these regulations provide employers with the necessary tools to navigate and comply with the new law effectively. As employers update their policies and practices, staying informed and proactive will be essential to fostering a compliant and supportive work environment in Illinois.

What Should Employers Do Next?

Employers should review their Pre-Existing Paid Leave Policies, and other practices for compliance with the final IDOL regulations.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business and will continue to monitor these new regulations and related litigation. If you have questions, please contact your HRBP for assistance.

Louisiana revises the Concealed Carry Law

In February, Governor Jeff Landry of Louisiana called a special session of the Legislature to address crime in the state. During this session, the Legislature passed a new state law that will make it to legal carry a concealed weapon in public. The law will take effect on July 4, 2024, and will allow any person who is a non-felon and over 18 years of age or older to carry a concealed weapon in public without a license or permit, with few exceptions.

The law will prohibit carrying handguns in certain locations such as schools, government buildings, places of worship, and voting locations. Additionally, concealed weapons will not be allowed at any private or public location where signage indicating “No Firearms Allowed on the Premises” is properly posted.

What should employers know?

Employers still retain the right to restrict anyone, including employees from possessing a handgun or firearm on the employer’s premises, provided the employer has properly posted signs “No Firearms Allowed on The Premises” at the entrances of businesses and conspicuous areas inside the location. Important to note is that Louisiana state law does permit anyone to carry a legally owned and possessed firearm in their personal vehicle, even when on an employer’s property.

Employers should take the time to educate employees about the new concealed carry law and your expectations and rights as the employer, while continuing to provide a safe environment for all employees. It is also recommended that employers review and update the safety policies and procedures to ensure their policies cover all aspects of workplace violence prevention within their organizations.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business and will continue to monitor these new regulations. If you have questions, please contact your HRBP for assistance.

Connecticut’s expanded paid sick leave law for workers in Connecticut

On May 21, 2024, Connecticut Governor Ned Lamont signed new legislation that will expand the state’s existing paid sick leave law. This new law will cover all employers and workers in Connecticut, with some exclusions for seasonal employees and specific unionized workers, beginning January 1, 2025. Currently, paid sick leave is only made available to employees who meet the legally defined service worker designation and is only applicable to those employers employing 50 or more employees.

The new law will incrementally reduce the threshold number of employees from 50 to 1, between January 1, 2025, and January 1, 2027, resulting in all Connecticut employees being covered by these new regulations by the final January 1, 2027, date. Below is a breakdown of the dates referenced:

- January 1, 2025: Employers with twenty-five or more employees will need to provide paid sick leave.

- January 1, 2026: Employers with eleven or more employees will need to provide paid sick leave.

- January 1, 2027: Employers with just one employee will need to provide paid sick leave.

Employees will start earning paid sick leave from their first day on the job but not be permitted to use it until they have worked for 120 days or more. Sick leave will accrue at a rate of 1 hour for every 30 hours worked, up to 40 hours per year. Employees can carry over up to 40 hours of unused sick leave to the next year, and employers can limit that usage to 40 hours per year. Employers may also choose to frontload the entire 40 hours of paid sick leave for employees to utilize at the immediate start of each new year.

The new law also broadens the reasons employees can take paid sick leave. These reasons include the following:

- An employee or family member’s illness, injury, or health condition (including care, diagnosis, and treatment).

- Preventive medical care for an employee or family member.

- An employee’s mental health wellness day.

- Closure of an employer’s business or a family member’s school due to a public order or public health emergency.

- If an employee or their family member poses a risk to others due to exposure to a contagious illness.

- If an employee or their family member is a victim of violence or sexual assault (unless the employee is the perpetrator).

Employers are not permitted to ask employees for proof that they are using sick leave for a covered reason, nor can they require employees to find someone to cover their shift.

Lastly, employers must inform employees about the new law by displaying a poster to be created by the Connecticut Department of Labor in a visible place at work and giving written notice to current employees by January 1, 2025. Employers must also provide this notice to new employees when they are hired. Employers will be required to provide updated notification to the employees in every paystub informing them of 1) the number of paid sick leave hours accrued by or provided to the employees, and 2) the number of hours used during the year. Retention of these records is required for three years. Employers are encouraged to review their existing Paid Sick Leave policies now to better prepare for compliance with the upcoming effective dates.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business If you have questions, please contact your HRBP for assistance.

U.S. Department of Labor’s New Salary Thresholds Reminder

As a reminder, on April 23, 2024, the U.S. Department of Labor (DOL) finalized the new salary requirements for workers considered “white-collar” salary exempt and highly compensated employees, with the first effective date of July 1, 2024. Employers nationwide should be reviewing their exempt employees’ salaries for compliance now if they have not already done so.

A comprehensive review of these changes was published in the May 2024 version of Insights and can be found here for reference.

Salary exempt employees are workers that are otherwise exempt from the Fair Labor Standards Act’s minimum wage and overtime protections which require workers to be paid an overtime premium of 1.5 times their regular hourly rate of pay for all hours worked over 40 in a workweek.

The exemption from this overtime payment applies to those workers that are employed in the bona fide administrative, executive, or professional (EAP) capacity, otherwise known as the “white-collar” exemptions as well as the highly compensated employee (HCE) exemption.

New Thresholds and Deadlines:

The DOL’s incrementally imposed new regulations will raise the salary threshold for workers classified as administrative, executive, and professional (EAP) exempt beginning on July 1, 2024, with another increase scheduled for January 1, 2025. The initial increased salary threshold is to $844 a week ($43,888 annualized) no later than July 1, 2024, with the second increase to $1,128 ($58,656 annualized) by January 1, 2025.

The highly compensated employee exemption will also see an incremental increase, with the first one to $132,964 on July 1, 2024, and then to $151,164 on January 1, 2025. Thereafter, all salary exempt classifications will automatically be updated and increase every three years beginning July 1, 2027, to reflect current earnings data and will be determined by applying to available data the methodology used to set the salary level in effect at the time of the update.

Although these new regulations have already faced multiple legal challenges, employers should remain vigilant about wage and hour compliance efforts. In light of these recent challenges and significant Supreme Court rulings, PrestigePEO will continue to monitor these developments and provide updates accordingly.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business. Please contact your HRBP or HRC for further guidance if you have any questions.

The U.S. Supreme Court overturns a decades-old decision – what now?

Several monumental cases have been pending in front of the Supreme Court of the United States this term, one of which has been closely watched as potentially changing the regulatory framework upon which policy decisions are made and enforced in this country.

On Friday, June 28, 2024, the Supreme Court of the United States published its ruling on what has become known as the Chevron doctrine, overturning the forty-year-old landmark decision that required courts to give deference to a federal agency’s interpretation of a Congressional statute, when that statute was challenged as nebulous or in need of further interpretation. This new ruling now requires that courts “exercise their independent judgment when deciding whether an agency has acted within its statutory authority.”

The ruling now allows for any agency action or regulation that is challenged in court to be decided by judicial interpretation as to whether an agency’s authority has been properly delegated by statute, and if ambiguous, the courts will decide if the agency acted within its statutory authority instead of giving immediate deference to the agency’s interpretation of a law.

The burning question on every employer’s mind is how this ruling will impact their operations. The answer is significant. This new ruling will impact challenges to federal agency authority and rulemaking across all agencies, including those that affect the daily employee and employer relationships. These agencies include the Department of Labor, the National Labor Relations Board, the Equal Employment Opportunity Commission, the Occupational Safety and Health Administration, the Federal Trade Commission, the Office of Federal Contract Compliance, and the Department of Homeland Security, among others. Experts agree that the future is complicated as courts are now empowered to strike down agency rules and regulations much easier, which will create a patchwork of various new rules across states. This is likely to impact every imaginable federal agency rule, including but not limited to DOL wage and hour rules, overtime rules, salary threshold exemptions, EEOC’s impact on discrimination and harassment compliance and litigation measures, OSHA regulations related to workplace safety, and many others.

An immediate example of how this decision will impact employers comes from a June 30, 2024, district court ruling, wherein The State of Texas, as a governmental employer, previously challenged the Department of Labor’s new salary exempt threshold that went into effect on Monday, July 1, 2024. The district court temporarily suspended the rule as it applies to The State of Texas as an employer, finding that the State does not have to comply with the new overtime rules, agreeing that Texas will likely win its underlying legal challenge that the Department of Labor exceeded its rulemaking authority by requiring the increases to salary thresholds. This temporary suspension does not apply to all employers, including private employers in Texas, but only to The State of Texas as an employer, allowing Texas to avoid any wage increases to state employees while the underlying lawsuit remains pending.

Given the anticipated increase in litigation, employers must continue complying with all federal rules and regulations, including the DOL’s new salary threshold requirements, until further notice of applicable court rulings. Prestige PEO is committed to supporting your business and will continue to monitor and update these changes as they become available.

PrestigePEO is here to help.

PrestigePEO is focused on supporting your business. Please contact your HRBP for further guidance if you have any questions.

Earn Rewards for Referrals

PrestigePEO wants to say thank you for being an amazing client! As part of PrestigePEO’s client rewards program, you can now earn up to $2,500 for every new client referral you make.

To submit a referral, visit www.prestigepeo.com/referrals. We’ll review your submission, and you will receive a reward for any referral who becomes a PrestigePEO client. Continue to earn rewards by bringing in more referrals.

Change Healthcare Breach Update

We want to provide you with an update regarding the recent Change Healthcare data breach and its potential impact.

Change Healthcare experienced a data breach in February, prompting an investigation that began in March. It has come to light that personal and health information may have been affected. While the specifics are still being determined, we expect detailed information to be available by the end of July.

This incident could potentially affect members of Aetna, UnitedHealthcare (UHC), and other carriers. Rest assured, Change Healthcare will notify any affected individuals on behalf of Aetna and UHC. For those with insufficient contact information, HIPAA Substitute notices will be provided.

PrestigePEO is closely monitoring the situation and will keep you informed as more information becomes available. If you have any questions, please do not hesitate to contact your HRBP or HRC.

Feedback

If you have an idea for a future newsletter, we’d love to hear from you! Additionally, if you’d like more information on our services or programs, we can certainly accommodate that as well. Email marketingteam@prestigepeo.com today!