Open enrollment is a great time to assess client needs and tailor their benefits options. A PEO can assist.

Key takeaways:

- Open enrollment creates opportunities to help your clients assess their needs and tailor their employee benefits options.

- Strategies to help them maximize benefits include:

- Understanding client needs

- Educating them

- Customizing benefits packages

- Leveraging technology

- Partnering with a PEO can help your clients have a smoother open enrollment.

As a benefits advisor or broker, part of keeping clients satisfied and successful is helping them maximize the employee benefits they provide to their employees. Your goal should be to deliver as much value as possible from your services in this area.

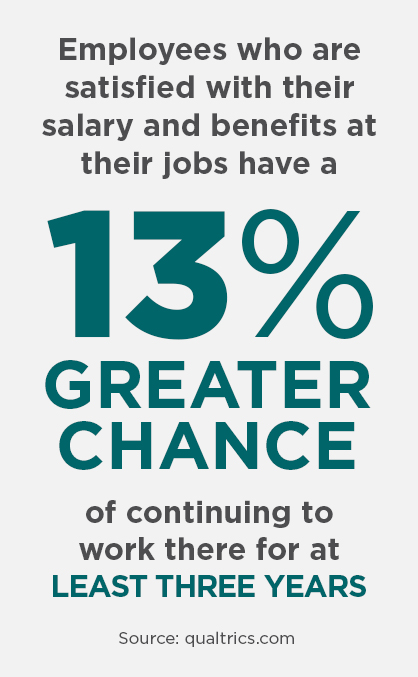

Benefits are just as important to employees as their salaries. Qualtrics found that employees who are satisfied with their salary and benefits at their jobs have a 13% greater chance of continuing to work there for at least three years. Because employee benefits are a top priority for employees, additional value comes from choosing the right options, balancing costs and paying attention to employee needs.

Your clients’ annual renewal season or open enrollment period provides the perfect opportunity to revisit the value you’re providing. You play a critical role in guiding your clients through the process and all the decisions that come with it.

Why Open Enrollment Matters

Open enrollment is the one time of year that current employees can select new insurance and other benefits options (unless they undergo a qualifying life event, such as getting married or having a child). Plan types and costs may change each year.

This is a crucial moment for your clients. Open enrollment:

- Provides an opportunity to educate employees about their coverages.

- Highlights all the company’s benefit programs.

- Gives businesses a chance to encourage employees to take full advantage of their benefits.

- Allows for an annual review of the budget and benefit comparisons.

- Validates the relationship and value proposition between you, your client and a PEO (more on that below).

Make sure you emphasize with clients that open enrollment is more than just an enrollment window. It can help the organization increase employee satisfaction and retention through benefits optimization and employee communication.

How to Help Your Clients Choose the Best Employee Benefits Packages

So, how do you best support your clients during open enrollment? Here are a few ways to ensure benefits optimization:

1. Understand Each Client’s Needs

Each of your clients is going to have different business priorities and budgets. Conduct a needs assessment for each to understand the priorities and needs of their unique workforce. Fully grasping what a business needs will help you work together to tailor and select benefits options. Some key questions to ask include:

- How have the needs of your client changed in the past year?

- Has there been an increase or decrease in the workforce?

- Have contribution amounts changed

- Is there new leadership who might like to change the company’s overall benefit strategy?

Open enrollment is a great time to assess and consult.

2. Educate Your Clients

Open enrollment is also the perfect time to educate your business clients – both your primary contacts and the entire staff at their company. This could mean introducing them to new benefits tools, filling them in on industry trends and data or explaining all of their benefits options carefully. Provide comprehensive information about types of benefits and the enrollment process so they can help their employees have a fruitful open period, as well.

3. Customize Employee Benefits Packages

Once you know what each client’s employees want and what the budget allows, you can start customizing benefits options to align with those priorities. Businesses will appreciate tailored offerings, and they won’t have to waste time looking through plans they can’t afford or don’t need.

4. Leverage Technology

A smooth open enrollment process requires the latest digital tools and platforms in the HR world. HR software or the latest mobile technology can help with benefits selection, sending reminders, pulling in employee information, and coverage enrollment and review.

How PrestigePEO Helps Simplify Open Enrollment

Annual open enrollment is made easier when businesses have a partner. Here are just a few benefits your clients receive from working with PrestigePEO:

- Comprehensive employee benefits packages: We help your clients access a range of competitive employee benefits options, including health insurance, retirement plans, wellness programs and more.

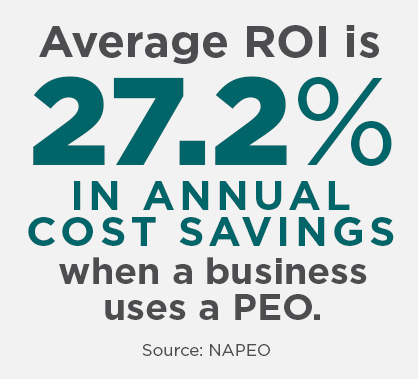

- Cost-efficiency: Because PEOs have group buying power, clients get access to premium benefits at competitive rates that are usually reserved for large companies. NAPEO found that the average ROI is 27.2% in annual cost savings when a business uses a PEO.

Businesses need expert support and access to better benefits options, and that’s exactly what working with a PEO provides.

- Better processes: PrestigePEO simplifies open enrollment by enhancing processes with tech tools and dedicated support. Technological platforms provide additional streamlining and convenience to help all parties better manage open enrollment.

- Employee communication: Employees need to know exactly what their options are and the advantages of each benefit option. PrestigePEO helps businesses access the information they need to keep employees educated and well-informed every step of the way.

Why Brokers Should Partner with PrestigePEO

So, what’s in it for brokers? Take a look at these key advantages of a broker-PrestigePEO partnership:

- Enhanced support: PrestigePEO has a dedicated account team that customizes services to meet your and your clients’ needs, so you get personalized support that then reaches down to your business clients. This includes keeping brokers involved in all communications; you’re the first to review renewal rates and benefits options to provide your clients with the best advice and direction possible.

- Improved client satisfaction: Our support creates smoother open enrollment experiences, so your clients are more satisfied with the entire process.

- Competitive services: A PEO partnership helps you stand out to business clients, as they will receive more support, expertise and benefits options with a PEO.

The three-pronged client-PEO-broker relationship is key to helping small businesses access better benefits and establish a successful open enrollment process.

Harnessing Better Open Enrollment Strategies for Your Clients

The open enrollment period – and the time leading up to it – will be much smoother and more effective when you focus on education, understanding client needs and leveraging technology to fill in any gaps.

But one of the best steps you can take as a broker is partnering with a PEO, which in turn helps your clients access more comprehensive benefits packages during open enrollment.

Find out more about what PrestigePEO offers its broker partners and their clients by reaching out to our team today.