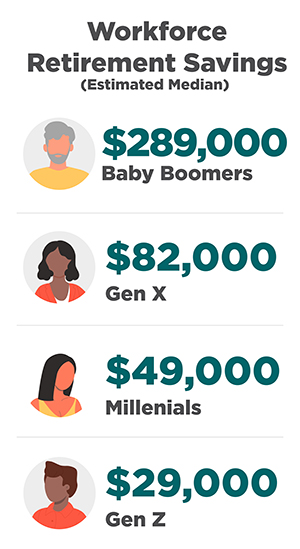

Americans are not saving enough for retirement. Recent surveys from the Transamerica Center for Retirement Studies reported that workers in the Baby Boomer, Generation X, Millennial, and Generation Z age groups have a collective estimated median of only $65,000 saved in total household retirement accounts.

The 2023 survey showed Baby Boomers who are still in the workforce have saved $289,000 (estimated median) in total household retirement accounts, and Gen X workers hold an average of $82,000 (estimated median). Employed Millennials have about $49,000 saved in retirement accounts, and Gen Z has an estimated retirement savings of $29,000. Alarmingly, the same study also found that 32% of Generation X and 21% of Baby Boomers who are still working have less than $50,000 in retirement savings, and 9% of workers from all generations have no retirement savings whatsoever.

America is experiencing a retirement savings crisis, and many states are stepping in to mitigate a spending increase that could reach hundreds of billions of dollars over the next 20 years.

As of October 2023, nine states have active retirement laws, 10 states have passed legislation, and 27 states have introduced legislation to temper the risk of financial insecurity in retirement for the American workforce. These mandates and state-sponsored plans vary by state, size of business, and other factors.

Small and medium-sized business owners across the US are now faced with navigating their state’s new or forthcoming laws and the compliance headaches they bring. More than ever, they will rely on their trusted benefits broker to walk them through all the compliant Professional Employer Organization (PEO) plans available to them and advise on whether settling for state-sponsored retirement plans is the best strategy for their growth trajectory.

Here is what you need to know and some steps you can take to alert SMB owners to the retirement options in your PEO partner’s portfolio and how they can help ensure compliance, mitigate penalty risks, and seize the opportunity to broaden the scope of attractive, cost-effective employee benefits for small business.

What are State-Mandated Retirement Plans?

State-mandated retirement plans are a strategy in which the state works with employers (usually small business owners) to improve access to secure retirement savings. These plans are intended to mitigate what the Pew Research Center projected to be a $334.3 billion shortfall in aggregate spending that states may face from 2021-2040 because of insufficient retirement savings.

To do this, the state establishes an individual retirement account (IRA) for its residents and either manages the plan themselves or hires a third party to do so. If employers don’t include qualified retirement plan options in their benefits packages, they must enroll workers in one provided by the state. State-mandated retirement plans often include conveniences such as employer-facilitated salary deductions with employee opt-out and adjustable contributions.

The specific requirements—and non-compliance penalties—of mandated retirement plans vary by state. In this article, we’ll discuss how you can help your SMB clients ensure compliance with their state’s mandate, stand out to job seekers, and provide them with confidence that they and their employees will be able to retire comfortably when the time comes.

1. Why are Retirement Plans Important?

Retirement plans are crucial to a secure financial future. Although there is no definitive amount of money that will guarantee economic security, consider the following points when discussing this topic with your clients:

- Retirement can last 30 years or more.

- A person may need up to 80% of their current annual income to retire comfortably.

- The average monthly benefit paid to retirees by the Social Security Administration is $1,200.

- The full retirement age for people born after 1960 is now 67 years old.

When your client includes PEO retirement plans in their employee benefits offerings, they create a way for their workers to start investing in their retirement now so they can enjoy peace of mind later.

2. What is a Qualified Retirement Plan?

While state-mandated plans offer a standardized approach, small business owners have the flexibility to design qualified retirement plans that align with their unique workforce and financial goals. This autonomy empowers them to create enticing employee benefits packages.

Instead of enrolling in a state-run retirement plan, you can help your SMB clients opt for various qualified retirement plans. Professional employer organizations like PrestigePEO have a wide range of retirement plan options, making PEO retirement plans a great option for your clients whether they live in an area with state-mandated retirement plans or not.

Partnering with the right PEO allows you to work with your client to find the plan that fits the needs of both employer and employee. PEO retirement plans can include features such as traditional pre-tax optional Roth deferrals, Safe Harbor employer contribution options, discretionary match or profit-sharing, investment advisory services from leaders in the finance industry, dedicated plan administrators, and cost-benefit comparisons.

3. What SMB Owners Should Know About State-Mandated Retirement Plans

To your client, enrolling in a state-run retirement program may seem like a simple way to adhere to state regulations and avoid penalties, but they should know that not only do these plans give them less control over plan design and contribution structures, but they also still do not mitigate non-compliance risks.

Even when enrolled in a state-mandated retirement plan, your client is still required to meet specific criteria, including contribution percentages, employee eligibility, and reporting obligations. This requires meticulous record-keeping and reporting, which adds an enormous administrative burden onto your client. Failure to adhere to these guidelines can result in noncompliance penalties, a risk that emphasizes the added security and convenience PEO retirement plans bring to small business clients.

4. How a Benefits Broker Can Help

Thankfully, there is a solution you can offer your SMB clients to help them avoid the additional burdens of state-mandated retirement plans, all without significantly increasing the workload carried by the benefits broker or the client.

A PEO-partnered benefits broker is well-positioned to deliver retirement plan options that can be customized to the specific needs of each SMB client’s business. Additionally, PEO retirement plans outsource administrative requirements to the professional employer organization, alleviating the burden on your clients.

With you as the intermediary, your PEO partner can significantly broaden employee benefits for your small and medium-sized business clients, and offer HR advantages and benefits outsourcing, all in one place.

Finding compliant retirement benefits for their business can either be one more issue your client has to worry about, or it can be one more issue solved by you, through a PEO partnership.

To learn more about the retirement plan services you can offer your SMB clients through PrestigePEO, visit us at https://mymepconnection.com/prestige/.

To help prep your pitch for the PrestigePEO Retirement Plan, watch our webinar and see the presentation slides here: https://www.prestigepeo.com/webinars/retirement-plan-webinar/.

Determining if Your SMB Client is Compliant with State-Mandated Retirement Plan Laws

Staying informed of evolving compliance laws is a full-time job by itself. This is one of many areas in which a PEO partnership proves its value for both the benefits broker and their client. Rather than investing time in trying to evaluate the status of your client’s regulatory compliance, connect them with your PEO partner’s experts.

PrestigePEO’s compliance and risk management team will do the work for you. Once your client’s offerings have been evaluated, you will have the resources you need to offer personalized solutions—not just for retirement plan mandates, but for any of your client’s benefits outsourcing and HR administration needs.

1. If Your Client’s Business is Not Yet Compliant

Depending on which state your client is in, failure to comply with their state’s retirement plan mandate can result in per-employee penalties in the hundreds of dollars. You can help your client achieve compliance and even help them build out their portfolio of employee benefits by connecting them with a PEO.

2. If Your Client’s Business is Already Compliant

If your client’s business is already in compliance with their state’s mandated retirement plan laws, you can check in with them to see if they’re still happy with their other benefits offerings.

By regularly evaluating and enhancing the benefits your client already has in place, you can help them maintain the most competitive employee benefits packages that improve employee retention and recruitment.

Employee Benefits for Small Businesses: Advantages of Diversifying Your Client’s Offerings

When your SMB clients are looking for retirement benefits solutions, don’t forget you have the power of a PEO in your back pocket! Aside from alleviating administrative burdens and fiduciary liabilities for your client, helping them diversify their employee offerings has a multitude of benefits for you and your client.

1. Advantages for the Benefits Broker

Licensed brokers who are partnered with PrestigePEO get commissions on 401(k) benefits as well as lifetime payouts and competitive PEO broker commissions. Getting your client into a PEO plan for retirement benefits is easier than ever. Here’s why:

- Knowledge of and experience with the scope of your PEO partner’s benefits are already in your toolbox.

- PEOs allow you to offer all-in-one benefits outsourcing and HR advantages to your client.

- Reducing the number of vendors your client has to keep track of takes work off their plate and solidifies you as their go-to broker for all their business needs.

By opening a conversation with your client about diversifying their employee benefits portfolio through a professional employer organization, they will see that PEO offerings and services:

- Ensure their compliance with federal, state, and local labor laws.

- Provide highly valuable benefits at highly competitive cost.

- Outsource 95% of their administrative tasks.

- Bring cost-effective business solutions that allow them to optimize their work hours.

2. Advantages for Small and Medium-Sized Business Owners

In the search for retirement plan solutions, business owners are looking for five key aspects in their 401(k) plan: easy administration, competitive cost, minimal fiduciary liability, compliance, and assistance from well-known advisors.

When you enroll your clients in a PrestigePEO retirement plan, they get a turnkey 401(k) strategy, easy administration with sales and prospecting support, minimized fiduciary liability, regulatory compliance, and reduced audit costs.

Our investment and plan advisors can provide cost and benefit comparisons to see how our small business 401(k) plans can help save your clients money and get a better return for them and their employees.

PrestigePEO also staffs dedicated in-house retirement specialists available to answer questions from you, your client, and their employees, as well as assist with plan contributions, management, and any applicable tax filings.

As you know, the relationship you have with your client isn’t just about keeping up with compliance; it’s about enhancing their business and helping it grow.

PrestigePEO: The Broker’s PEO

As of 2023, PrestigePEO has been in operation for over 25 years. Our business could not have been built without the support of benefits brokers like you. Our vision is to deliver high-touch HR services and benefits that bring peace of mind to your clients, but our focus is—and always has been—on our broker partners. We are just as dedicated to fostering our relationships with our broker partners as you are to fostering your relationships with your clients.

If you are interested in learning more about becoming a PrestigePEO broker partner, visit our website to review our PEO broker partner advantages, current partner incentives, compensation model, and more at https://www.prestigepeo.com/for-brokers/.